Product-Led Growth (PLG): Definition, Core Components, Metrics, and GTM Choices for U.S. SaaS

If you lead a U.S. SaaS company in 2025, you’ve likely felt the shift: prospects want to try first, talk later. Product-Led Growth (PLG) meets that expectation by letting your product do the heavy lifting across acquisition, activation, retention, and expansion. Done well, PLG lowers CAC, accelerates time-to-value (TTV), and surfaces high-intent opportunities for sales without sacrificing enterprise rigor.

What PLG Is—and When It Fits

At its core, PLG uses the product—as opposed to marketing or sales—as the primary engine for acquiring, activating, retaining, and monetizing customers. This view is consistent with Amplitude’s overview of PLG mechanics, which emphasizes delivering value in-product across the full journey in order to scale efficiently (Amplitude’s “What is PLG?” guide, updated in 2023).

Where it fits best:

- Low-to-moderate product complexity with a fast path to value

- Clear, repeatable jobs-to-be-done and strong collaboration/network effects (invites, shared docs)

- Broad market with many self-serve buyers; ACV that supports efficient self-serve or light sales-assist

- Leaders committed to instrumentation, experimentation, and cross-functional alignment

If your product requires heavy implementation or bespoke security reviews, you can still apply PLG principles (free trials, in-app guidance) but likely need a hybrid, sales-assisted motion for larger accounts.

The Five Levers That Drive 80% of PLG Outcomes

- Define activation precisely by segment

- Identify the moment when a user first experiences core value (your “aha”).

- Tie activation to downstream retention via correlation analysis; track activation rate and TTV by segment.

- Design first-session onboarding to reach the “aha”

- Guide users contextually—avoid long, linear tours.

- Personalize early steps by role or use case; show progress and reduce empty states.

- Nudge upgrades at natural usage limits

- Package pricing around value metrics (seats, projects, storage) and premium capabilities.

- Use usage caps and feature gating to make the upgrade path obvious, not punitive.

- Operationalize PQLs and PQAs, not just MQLs

- Score users/accounts on behavior + fit; route high-intent accounts to sales-assist quickly.

- Instrument events and run weekly experiments

- Build a clean event taxonomy; track funnels, cohorts, retention, and expansion.

- Ship changes weekly; review leading indicators (activation/TTV) and follow-on monetization.

Onboarding Patterns That Shorten Time-to-Value

Generic product tours are often ignored or forgotten. UX research shows contextual, just-in-time guidance improves task success and reduces cognitive load—exactly what early users need to hit activation. Nielsen Norman Group summarizes this in their 2023 article on onboarding, advocating progressive disclosure and embedded help over one-off tutorials (NN/g, “Onboarding Tutorials Are Often Ineffective,” 2023).

Actionable patterns:

- Progressive disclosure: Trigger help in context when the user attempts a task.

- Role-based checklists: Tailor to admin vs contributor; display progress visibly.

- Empty states that teach: Seed example data, templates, and sample projects so users can “see success” immediately.

- Nudge sequencing: Time prompts around activation milestones; avoid premature upsell.

- Feedback loops: Use lightweight in-app surveys and analytics to identify friction and iterate.

In practice: If activation for “Team Collaborators” is “create a project and invite 2 teammates within 3 days,” then your first session should guide project creation, suggest a relevant template, and make inviting teammates feel like a natural next step.

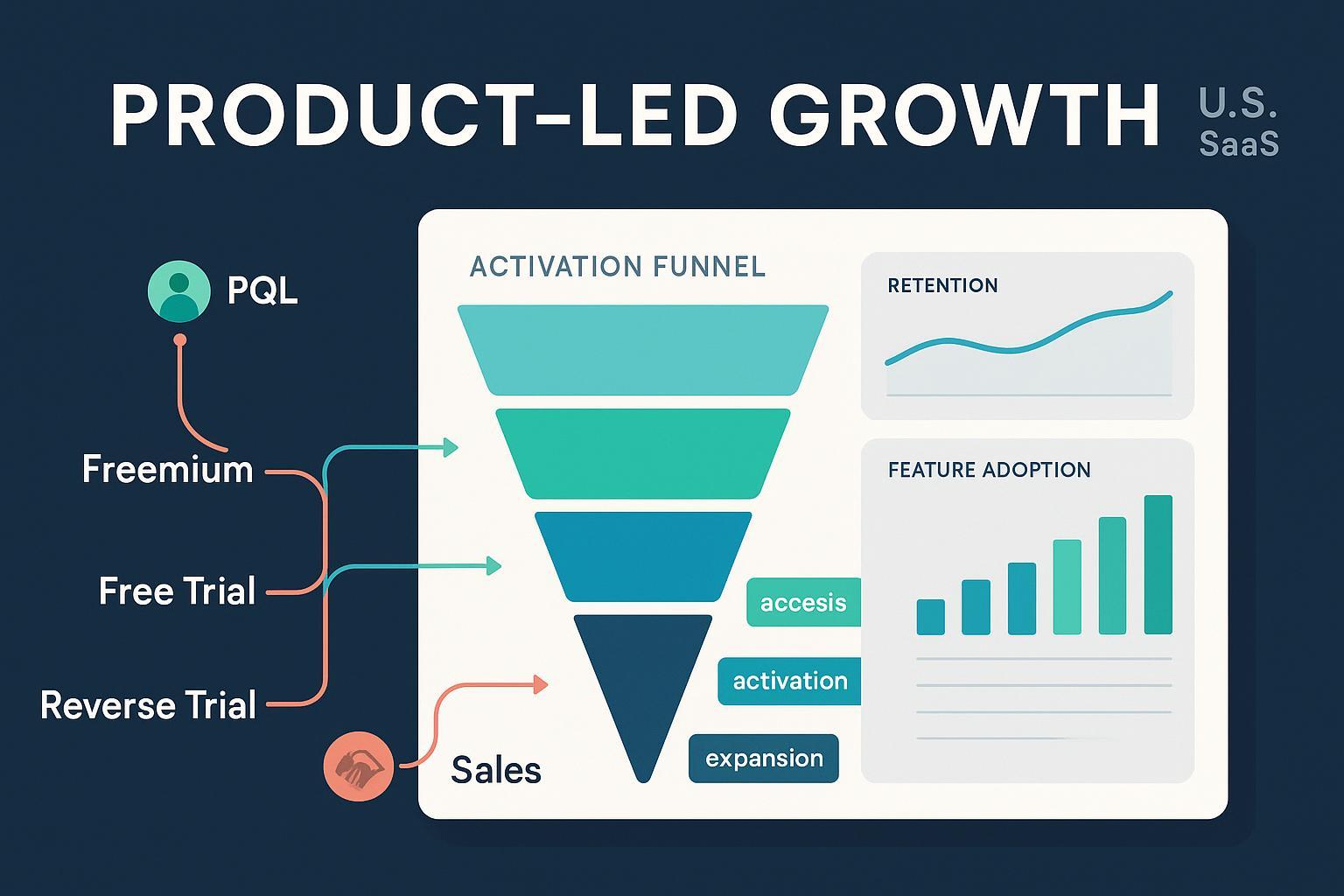

PQLs and PQAs: From Product Signals to Pipeline

Marketing Qualified Leads (MQLs) miss the richness of in-product behavior. In PLG, Product-Qualified Leads (PQLs) are the individuals who have shown buying intent by hitting usage and value milestones. Product-Qualified Accounts (PQAs) aggregate those signals at the account level.

What to include in qualification:

- Behavioral signals: activation completed, usage caps hit, premium feature touches, integrations installed, invite velocity, pricing-page visits.

- Fit signals: firmographics (industry, size), ICP role mix (user + admin + exec), security/compliance needs.

- Intent context: upcoming renewal or trial expiry; recent executive activity.

Routing and SLAs (sales-assisted PLG):

- Prioritize by (fit x engagement). For high-fit/high-engagement PQAs, trigger a fast, consultative outreach within 24 hours.

- Sync product usage to CRM so reps see milestones inside their workflow.

- Start with pilot rules; review conversion weekly and iterate. McKinsey’s 2023 perspective argues that hybrid “Product-Led Sales” typically outperforms pure PLG at enterprise scale when reps act on product signals rather than cold outbound (McKinsey, 2023: From PLG to Product-Led Sales).

Monetization Choices: Freemium, Free Trial, or Reverse Trial?

Freemium

- Best when TTV is fast and collaboration/network effects amplify value (e.g., team invites, shared workspaces).

- Use value-based caps (seats, projects, storage) and keep the free tier genuinely useful.

- Fit for higher-complexity products or premium features that need demonstration; time gating creates urgency.

- Requires tight onboarding to get users to the aha moment within the trial window.

Reverse trial

- Start everyone in premium for a short period, then downgrade to free if they don’t convert—leveraging loss aversion.

- Retains non-converters in your ecosystem and often lifts conversion vs classic freemium.

For a balanced framework comparing these models and how product complexity, TTV, and network effects guide the choice, see the 2025 comparison from ProductLed.com (ProductLed, “Freemium vs Free Trial,” 2025).

Sales-Assisted PLG: When and How to Layer Sales

As your ACV rises and buyer committees grow, many accounts will need a human to help with procurement, security reviews, or ROI validation. The goal is not to abandon self-serve, but to guide high-potential accounts through a “sales-assist” lane triggered by product signals.

Handoff rubric you can pilot:

- Self-serve lane: low-fit or low-engagement users remain fully self-serve; nurture with in-app prompts and lifecycle emails.

- Sales-assist lane: PQAs that cross thresholds (e.g., multiple PQLs, premium feature usage, integrations to core systems) receive consultative help—think solutioning, templates, implementation pointers.

- Full sales lane: enterprise prospects with strong fit and economic potential engage AEs for multi-stakeholder buying.

Operational tips:

- Define thresholds per segment (SMB vs mid-market vs enterprise). Review monthly.

- Keep SLAs tight (sub-24 hours) and use playbooks that reference in-product behavior.

- Protect the self-serve experience—avoid gating essential value behind demo-only walls unless security/compliance requires it.

OpenView and McKinsey both highlight that Product-Led Sales works best when product usage data is ubiquitous across tools and teams; sales should never be “flying blind” without context from the product (OpenView’s Product-Led Sales blueprint, 2023).

Metrics That Matter (and How to Read Them)

Activation and TTV

- Define activation for each key segment, then track activation rate and median/percentile TTV. Amplitude recommends correlating candidate activation events with downstream retention and iterating until the signal is strong (Amplitude PLG tactics, 2023).

Free-to-paid conversion

- Numbers vary widely by product and segment. Rather than chase generic benchmarks, monitor your conversion by cohort and model (freemium vs trial vs reverse trial) and run controlled experiments.

Retention and expansion

- Definitions you’ll need in board decks: GRR and NRR.

- GRR = (Beginning RR – churn/downgrades) / Beginning RR

- NRR = (Beginning RR – churn/downgrades + expansions) / Beginning RR For precise terminology and examples, see Maxio’s definitions (Maxio, “Gross Retention vs Net Retention”).

Directionally, public 2025 data suggests NRR medians around 101% across B2B SaaS, with expansion contributing a growing share of ARR at larger scale. Treat these as directional only and segment by ACV/vertical before comparing yourself to the market (Benchmarkit, “2025 SaaS Performance Metrics,” 2025).

Instrumentation stack essentials

- Product analytics (events, funnels, cohorts): Amplitude or Mixpanel

- Data collection/CDP: Segment or similar; enrich with firmographics

- Warehouse + modeling: Snowflake/Databricks + dbt for durable metrics

- In-app guidance: Pendo/Appcues for contextual onboarding and nudges

- CRM sync: Salesforce/HubSpot with product usage surfaced to reps

Common Pitfalls—and How to Avoid Them

- Unclear activation definition: If you can’t name your activation event per segment, run a correlations study this week and instrument missing events.

- Over-generous freemium: Giving away too much blurs upgrade incentives. Revisit value metrics and ensure caps align to real business value.

- Vanity metrics: Sign-ups without activation are expensive. Focus dashboards on activation, TTV, retained usage, and expansion.

- Experiment drift: Without a weekly cadence and guardrails, you’ll thrash. Create a single backlog and ship small, measured changes.

- Premature sales scaling: Add sales-assist where product signals justify it; otherwise you risk bloated CAC and channel conflict.

How to Get Started in 30 Days

Week 1: Define activation and TTV per segment; audit event tracking; draft your PQL/PQA criteria.

Week 2: Ship first-session onboarding fixes (checklist, templates, contextual tips). Add usage caps that align with value.

Week 3: Wire product usage into your CRM; pilot sales-assist SLAs on high-fit/high-engagement PQAs.

Week 4: Review cohort charts—activation, TTV, free→paid, and early expansion. Keep what works; queue two more experiments.

Closing

PLG isn’t a religion—it’s an operating system. Use your product to win self-serve customers faster, and let product data guide when humans help. If you’d like a pragmatic second set of eyes on your activation definition, onboarding flow, and PQL/PQA rules, reach out for a no-fluff PLG audit tailored to your U.S. SaaS context.