Best Practices for Google Ads at Each Funnel Stage (TOFU/MOFU/BOFU) for B2B SaaS in the U.S. [2025]

B2B SaaS teams in the U.S. are feeling the squeeze in 2025: rising CPCs, privacy-driven measurement gaps, and longer buying committees make “spray-and-pray” Google Ads unsustainable. The fix is a full-funnel approach with stage-specific objectives, creative, bidding, and measurement. Below is a practitioner-tested playbook drawn from multi-year B2B SaaS PPC programs—what to do first, how to run TOFU/MOFU/BOFU, and how to govern budgets with modern attribution.

Before diving into tactics, set up the measurement foundation that keeps AI bidding honest and budgets defensible.

1) Foundations That Make Smart Bidding Work

If you skip this section, your automation will optimize to the wrong signals. Do these first and verify monthly.

- Consent Mode v2: Implement consent parameters via gtag.js or GTM to preserve modeled conversions under privacy constraints. See Google Developers guidance in Consent Mode implementation (2025).

- Enhanced Conversions (web/lead): Hash first-party identifiers to improve match rates, stabilizing conversion measurement. Details in Enhanced conversions for web from Google Ads Help (2025).

- Offline Conversion Imports: Upload downstream conversions (MQL, SQL, SQO, Closed-Won) tied to GCLID/GBRAID/WBRAID to optimize toward quality, not just raw leads. Use Upload offline conversions (Google Ads Help, 2025) or the Google Ads API offline conversions docs (2025) for automation.

- Link GA4 to Google Ads and import key events: Ensure unified attribution and eligibility for data-driven models by following Link GA4 to Google Ads and Import GA4 conversions (Google Ads Help, 2025).

- Data-driven attribution (DDA): Where eligible, apply DDA in Google Ads to allocate fractional credit across touchpoints—critical for TOFU→BOFU budgeting. Reference About data-driven attribution (Google Ads Help, 2025).

Minimum viable thresholds:

- Aim for 30–50+ primary conversions per 30 days per portfolio/bid strategy for stable Smart Bidding. If you’re below this, broaden signals (e.g., include qualified micro-conversions) temporarily.

- Keep CRM stages clean and consistent. If sales reclassify leads weekly, your optimization target shifts and performance swings.

Compliance caveat: Coordinate with legal and data governance when enabling Enhanced Conversions and Customer Match. Document consent and retention policies.

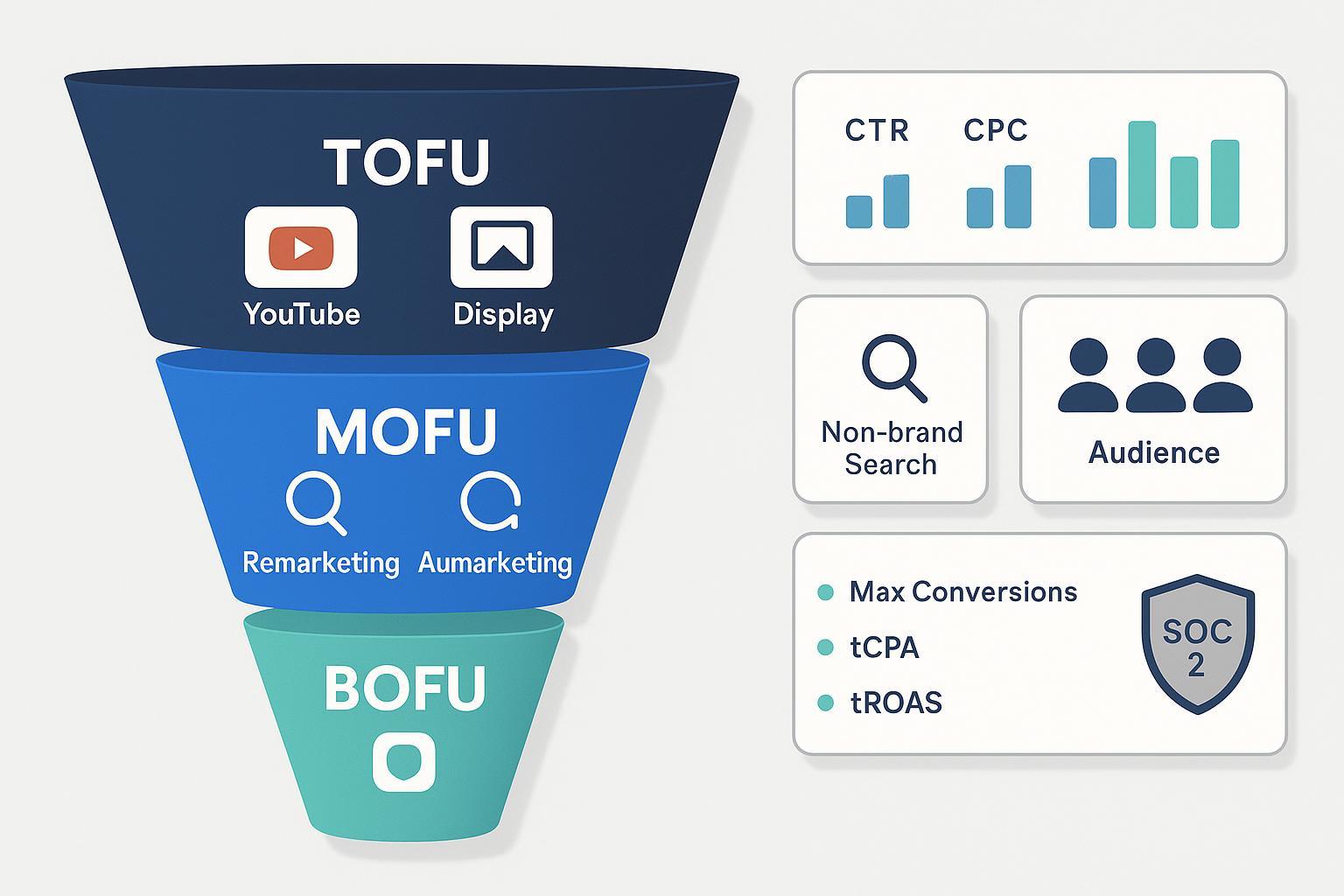

2) TOFU: Awareness That Doesn’t Waste Spend

Objective: Create qualified awareness and feed remarketing lists without burning budget on unqualified traffic.

Recommended channels and structures:

- YouTube (skippable in-stream) for category education and pain-point storytelling; high reach, low direct CVR.

- Display (managed placements) to reach relevant industry publications and communities.

- Performance Max (PMax) to expand reach across Google’s surfaces when you have enough conversion signal and strong audience hints.

- Broad Match Search only if you can enforce strict negatives and have conversion volume; otherwise start with phrase match and expand.

Audience tactics:

- Build custom segments from competitor domains and category keywords; layer in-market audiences for your ICP.

- Use Customer Match lists cautiously for awareness if you have opt-in content syndication or ABM cold outreach; otherwise reserve Customer Match for MOFU/BOFU.

Creative and offers:

- Problem-led assets: “Symptoms of [problem] in [vertical]” videos; RSAs that educate, not sell.

- Offer low-friction content: primers, checklists, frameworks. Avoid demo CTAs at TOFU unless it’s a PLG motion.

- Iterate faster using RSAs; Google added asset-level stats visibility in 2025, enabling granular headline/description learning as discussed in Google Ads unveils RSA asset stats by PracticalEcommerce (2025).

Bidding and budget:

- For YouTube/Display: Start with CPM/CPV goals aligned to reach; evaluate assisted conversions and view-through lift.

- For Search/PMax: Use Maximize Conversions with micro-events (e.g., engaged sessions, scroll depth tied to content downloads) if you lack lead volume. Switch to tCPA when you exceed 30–50 qualified conversions/month.

- Cap daily budgets and apply dayparting to U.S. business hours to avoid off-hours low-quality clicks.

Measurement and guardrails:

- Track assisted conversions and engagement metrics in GA4; expect low direct CVR but focus on list growth and MOFU lift.

- Maintain tight negative keyword lists; exclude job seekers, students, and irrelevant industries.

TOFU checklist:

- Define 2–3 custom segment recipes from competitor URLs and category queries.

- Launch YouTube in-stream with 3 hooks within first 5 seconds; cap frequency.

- Run PMax only with audience signals and solid conversion quality; otherwise postpone until MOFU.

- Configure view-through metrics and engaged-session goals in GA4.

- Add negatives weekly; set dayparting to 8am–6pm local time initially.

Common TOFU pitfalls:

- Over-relying on broad match without negatives and sufficient conversion signals.

- PMax with weak data—this typically over-delivers low-intent traffic. Ground PMax in strong conversion signals and audience hints per Performance Max campaigns overview (Google Ads Help, 2025).

3) MOFU: Consideration, Differentiation, and Lead Quality

Objective: Capture high-intent research traffic and convert qualified leads while warming known accounts.

Recommended channels and structures:

- Non-branded Search: Category and competitor queries (e.g., “best [category] for [ICP]”, “[competitor] alternative”).

- RLSA: Apply remarketing lists to Search to prioritize past visitors and content engagers.

- YouTube/Display retargeting: Nurture with comparison content, case studies, webinars.

- Discovery campaigns: Test for visual placements that perform well in retargeting.

Audience segmentation:

- Customer Match lists for MQLs, open opportunities, and users with specific product behaviors.

- Remarketing tiers by depth (e.g., visited pricing vs. top blog) and recency.

Creative and offers:

- Comparison pages, ROI calculators, case studies with quantified outcomes, and webinars.

- Emphasize differentiators and risk reducers (implementation support, security posture, SOC2/ISO)—critical for enterprise buyers.

- Use tCPA or tROAS with data-driven attribution when conversion volume supports it. See Google’s AI-powered Smart Bidding for strategy definitions (2025).

- Apply seasonality adjustments around product launches/events.

- Consolidate ad groups for stronger signal if your account is fragmented; avoid SKAGs unless you have high volume.

Measurement and quality gating:

- Define primary conversion as Marketing Qualified Lead (MQL) only if gated by quality rules (e.g., verified business email, job title fit). Exclude junk leads from primary conversions; track them as secondary.

- Import downstream stages (SQL, SQO) weekly via offline conversions to guide bidding toward revenue-likelihood.

MOFU checklist:

- Map non-brand keyword themes: category + competitor + “best/compare/alternative.”

- Build Customer Match segments for MQLs and open opps; set lookback windows.

- Launch RLSA campaigns with aggressive bid adjustments on high-intent lists.

- Use tCPA/tROAS with DDA when you hit 30–50+ quality conversions in 30 days.

- Align landing pages to intent: comparison for competitor terms; case study for category terms.

Common MOFU pitfalls:

- Treating all leads equally in conversion tracking, causing Smart Bidding to chase low-quality volume.

- Neglecting competitor exclusions; you can use brand exclusions where appropriate and keep negatives tight.

Context on 2025 market pressure: Non-branded B2B Search CPCs rose meaningfully year over year, with Dreamdata reporting CPC growth from $4.13 (Aug 2024) to $5.34 (Jul 2025) and CTR around 4.04% in their B2B Google Search non-branded benchmark (2025). Expect tighter economics and prioritize quality.

4) BOFU: Decision Acceleration and Revenue Alignment

Objective: Convert branded and high-intent traffic to demos, trials, and deals—and ensure bidding reflects revenue, not just form fills.

Recommended channels and structures:

- Branded exact-match Search with sitelinks (Pricing, Security, SOC2, Case Studies) and call extensions.

- High-frequency remarketing (Search/Display/YouTube) focused on objections and urgency.

- Performance Max when you have robust conversion quality signals and mature audience data.

- CRM-qualified lists: opportunities nearing close, trial users who stalled, past customers for upsell.

- Time-based recency windows and frequency caps to avoid fatigue.

Creative and offers:

- Clear CTAs: “Book Demo,” “Start Free Trial,” “Talk to Sales.” Include enterprise assurances (security badges, procurement guides).

- Pricing qualifiers to pre-filter non-fit traffic.

Bidding and value optimization:

- Maximize Conversions or Maximize Conversion Value with value rules for lead stages (e.g., SQO value > MQL). Pair with offline conversion imports as outlined in Google Ads Help’s Upload offline conversions (2025).

- Portfolio strategies across branded and remarketing campaigns to prioritize net-new revenue.

Measurement and governance:

- Enhanced Conversions improves match rates on BOFU events; see Enhanced conversions for web (Google Ads Help, 2025).

- Use data-driven attribution to capture assist value from upper-funnel touches; see About data-driven attribution (Google Ads Help, 2025).

BOFU checklist:

- Build branded exact campaigns with tight match types and comprehensive extensions.

- Segment remarketing by stage (trial, pricing page visitors, proposal sent). Apply higher bids to near-close segments.

- Assign conversion values by stage and import offline conversions for SQO/Closed-Won.

- Add objection-handling assets: security page links, implementation timelines, migration guides.

Common BOFU pitfalls:

- Treating branded traffic as “set and forget.” Regularly review query reports; add negatives for competitor-branded queries if necessary.

- Optimizing to raw form fills without revenue-stage values, causing automation to chase easy but low-value conversions.

5) Budgeting: Start Split and Rebalancing Rules

Starting point for many B2B SaaS teams:

- TOFU 20%

- MOFU 50%

- BOFU 30%

Adjust based on leading indicators:

- Shift +10–20% toward MOFU if TOFU list growth is strong but Sales-qualified rates are lagging.

- Shift +10–20% toward BOFU if pipeline is heavy in late stages and branded demand is rising.

- If MOFU CPCs spike beyond plan (market pressure), tighten intent (exact/phrase on highest-value terms) and use RLSA layering to preserve CVR.

Use DDA and incrementality tests:

- Run controlled geography or audience splits to measure incremental lift from YouTube/Display.

- Evaluate view-through and assisted conversions monthly; if TOFU is not driving measurable lift, reallocate.

Benchmark context for expectations: Cross-industry Google Ads CPCs and CPLs vary; WordStream’s 2025 update cites average CPC around mid-single digits and Business Services CPL over $100 in their 2025 Google Ads benchmarks (2025). Treat these as directional, not targets—optimize to your CRM-qualified metrics.

6) Reporting Cadence, QA, and Experiment Design

Weekly:

- Asset-level RSA checks (retire poor performers; pin sparingly where needed).

- Search term audit; add negatives; check match type drift.

- Budget pacing against stage goals; ensure dayparting aligns with performance.

Bi-weekly:

- Audience performance review (Customer Match, RLSA tiers); adjust bids and exclusions.

- Creative and offer testing cadence (new case study, new webinar angle).

Monthly:

- DDA path analysis and assisted conversions review; justify TOFU budgets with lift evidence.

- Offline conversion import QA (match rates, timing, value rules). Validate Enhanced Conversions hashing and consent logs.

- Funnel review: TOFU list growth → MOFU lead quality → BOFU revenue contribution. Rebalance budgets accordingly.

Experiment playbook:

- Define hypothesis, success metric (e.g., SQO rate, demo show rate), and guardrails (max CPA, min CVR).

- Run 2–4 week tests per variable; avoid overlapping experiments that confound attribution.

7) Advanced and 2025-Specific Tactics

- Customer Match precision: Ensure list eligibility and hashing per Google’s Customer Match requirements (Google Ads Help, 2025). Segment by stage and recency.

- Performance Max steering: Strong audience signals and conversion quality are prerequisites. Start narrow; expand assets and budgets only after proving incrementality. Reference Performance Max campaigns overview (Google Ads Help, 2025).

- Privacy-resilient measurement: Implement and monitor Consent Mode (Google Developers, 2025); expect modeled conversions and communicate uncertainty bands to stakeholders.

- Attribution sanity checks: Compare Google Ads DDA with GA4 reports; understand differences noted in Attribution models in GA4 (GA4 Help, 2025). Align KPIs and avoid “dueling dashboards.”

8) Applicability Limits and Trade-offs

- Automation without signal is budget drift: If you don’t have enough conversion volume or quality gating, Smart Bidding will chase easy forms. Temporarily broaden signals but restore strict definitions as volume grows.

- PMax can cannibalize branded traffic: Protect brand campaigns and monitor query compositions; use brand exclusions where appropriate.

- Long buying cycles need patience: TOFU impact often shows up in assisted conversions after weeks. Use incrementality tests and stakeholder education.

- Niche ICPs demand tighter controls: Lean on managed placements, exact match, and Customer Match to avoid waste.

Stage-by-Stage Quick Setup Templates

TOFU

- Campaigns: YouTube in-stream, Display managed placements, PMax (signals ready), limited Broad Search.

- Audiences: Custom segments (competitor domains/keywords), in-market; exclude job seekers/students.

- Bidding: CPM/CPV for reach; Max Conversions with micro-events if needed.

- KPIs: Reach, engaged sessions, remarketing list growth, assisted conversions.

MOFU

- Campaigns: Non-brand Search, RLSA, YouTube/Display retargeting.

- Audiences: Customer Match (MQLs/open opps), remarketing by depth and recency.

- Bidding: tCPA/tROAS with DDA; seasonality adjustments.

- KPIs: Qualified lead rate, CPL to MQL/SQL, opportunity creation.

BOFU

- Campaigns: Brand Search (exact), PMax with strong signals, high-frequency remarketing.

- Audiences: CRM-qualified (trial stallers, late-stage opps), pricing page visitors.

- Bidding: Maximize Conversion Value with value rules; portfolio strategies.

- KPIs: Demo/trial conversion rate, SQO rate, Closed-Won, payback/CAC.

Final Notes From the Trenches

- Negative keyword hygiene is a weekly ritual; don’t delegate it to monthly.

- Dayparting to U.S. business hours reduces junk clicks—verify by segmenting performance by hour.

- Pin RSA assets only when compliance or brand guidelines demand it; otherwise let the system learn.

- Keep one source of truth for funnel metrics (CRM) and train stakeholders on modeled vs. observed conversions.

With these foundations and stage-specific playbooks, your Google Ads program will align with 2025 realities—privacy, AI-driven bidding, and multi-touch journeys—and deliver reliable pipeline, not just clicks.