Best CRM for Small Manufacturers (U.S.) — Selection & Implementation Best Practices for 2025

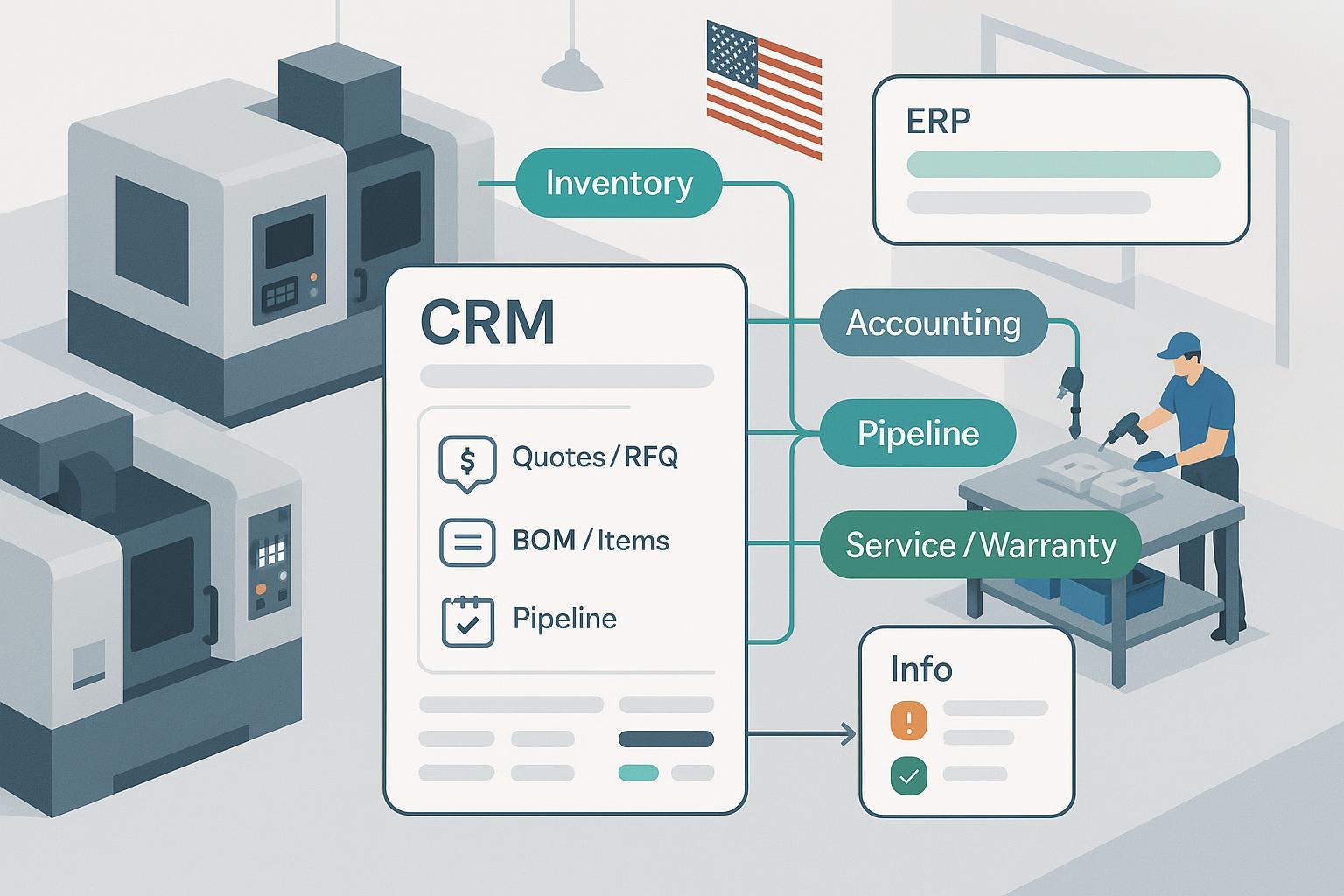

As a practitioner who has implemented CRM in multiple U.S. machine shops, contract manufacturers, and niche OEMs, I’ll be blunt: the “best” CRM for a small manufacturer is the one that fits your quoting-to-cash workflow, integrates cleanly with your ERP/accounting, and your team actually uses. This guide focuses on how to choose that fit—and how to implement it without stalling production or burning out a lean team.

What “best” means for small manufacturers in 2025

For a 20–200 employee manufacturer, the winning CRM usually balances five realities:

- Your RFQ/quoting process is the heartbeat. Multi-version quotes, approvals, and margin control matter more than flashy marketing features.

- ERP/inventory/accounting are your source of truth. Avoid swivel-chair data entry.

- After-sales service and warranty workflows are a competitive lever, not an afterthought.

- AI is helpful only if your data quality is decent. Otherwise it amplifies noise.

- Your team has limited time. Cloud tools with clear UIs usually win over complex, heavy customization.

Good vendor overviews exist, but they’re often generic. For manufacturing-specific features and trade-offs, the 2025 roundup by Method provides a solid baseline to compare options across quoting, ERP ties, and service modules (see Method’s 2025 manufacturing CRM guide: CRM for manufacturing: 16 best options).

Selection criteria that actually map to your shop-floor reality

Use these criteria during demos and proof-of-concepts. Score vendors 1–5 on each, then weight by importance.

- RFQ/Quote-to-Order

- Quote versioning and approvals (by margin or amount)

- Cost/margin visibility; guardrails for discounting

- Converting quotes to ERP sales orders without retyping

- Product/BOM and Pricing Sync

- Sync item masters, variants, and pricing tiers from ERP

- UoM, lead times, and substitution rules available to sales

- ERP/Accounting Integration

- Prebuilt connectors for your stack (QuickBooks, Business Central, NetSuite, Sage)

- Clear system-of-record rules for Customers, Items, Orders

- Error handling, retry logic, and reconciliation reporting

- Distributor/Dealer Management (if channel-driven)

- Territories, tiered pricing, MDF tracking

- Partner portals or lightweight deal registration

- Service/Warranty and Field Work

- Serial/lot capture, entitlement checks, RMAs

- Scheduling, parts/labor capture, mobile access

- Security/Compliance Fit

- ISO 9001-friendly document/record control

- CPRA/CCPA support for privacy workflows; audit logs

- Optional: ITAR controls (U.S.-person access, data residency)

- Usability and TCO

- Time-to-value with minimal configuration

- Admin overhead and true annual cost (licenses + connectors + services)

Why these? Because manufacturers get ROI when quoting gets faster and cleaner, orders and inventory stay accurate, and service issues are resolved visibly and quickly. Integration is the keystone; as NetSuite’s guidance on ERP integration emphasizes, treat data cleansing and a phased approach as first-class citizens to avoid brittle pipelines (ERP Integration Strategy — NetSuite).

Shortlist and fit notes (SMB-friendly)

-

HubSpot: strong automation and usability; broad marketplace connectors; good starting point if you need quick time-to-value and a modern UI. Deeper manufacturing needs often rely on apps/integrators. The 2025 Nutshell overview aligns with this positioning for SMB manufacturers (Best CRMs for Manufacturing 2025 — Nutshell).

-

Zoho CRM: highly configurable at an attractive price point; works well for distributor management and simple quote flows; ties to Zoho Books or third-party accounting.

-

Microsoft Dynamics 365 (with Business Central or other ERP): compelling if you want tight ERP-CRM coupling, field service, and warranty depth; expect higher complexity and the need for an experienced admin/partner.

-

Salesforce: an ecosystem play with virtually unlimited extensibility; plan for specialized admin capacity and careful cost governance.

-

Pipedrive: fast, simple pipeline and quoting; affordable; best for light manufacturing or early-stage teams who prioritize sales process clarity over deep ERP ties.

Tip: If you sell through distributors, weight channel features and price books more heavily. If you build-to-order, weight BOM/variants syncing and quote governance.

A pragmatic 3–6 month implementation plan (phased to fit small teams)

In 2025 guidance for SMBs, a realistic end-to-end CRM program takes about three to six months depending on scope, with a pilot-first approach to de-risk go-live. See the 2025 step-by-step overview by ERPSoftwareBlog for a structure you can adapt (Step by Step CRM Implementation Guide — ERPSoftwareBlog, 2025). Complementary timeline ranges are echoed by Mercurius IT’s discussion of common blockers in small-business rollouts (CRM Implementation Timeline — Mercurius IT, 2025).

Phase 0 — Alignment (1–2 weeks)

- Executive sponsor and cross-functional core team (Sales, Ops/Production, Finance, Service)

- Success criteria: quote turnaround time, order accuracy, on-time delivery, first-contact resolution

Phase 1 — Process mapping and selection (2–3 weeks)

- Map RFQ→Quote→Order→Invoice; Service→RMA→Close; define exceptions

- Shortlist and score vendors using the criteria above; validate key integrations on a sandbox/demo

Phase 2 — Data audit and cleanse (2 weeks)

- Standardize accounts/contacts, dedupe, normalize addresses and naming conventions

- Identify system-of-record per entity; document mapping

Phase 3 — Minimal Viable Configuration (4–6 weeks)

- Pipelines, fields, validation rules, quote templates, price books

- Integrations: start with accounting/customers/items; defer history until stable

- Role-based dashboards for Sales, Ops, Finance, Service

Phase 4 — Pilot (4 weeks)

- 6–10 champion users; weekly feedback loops; adjust workflows and training

- Exit criteria: quote SLA met, order accuracy improved, sync stability confirmed

Phase 5 — Rollout and hypercare (4–6 weeks)

- Train the broader team; help desk hours; monitor adoption and errors daily

- Weekly clinics for the first month; shift to monthly optimization thereafter

Guardrails

- Prioritize “configure over customize.”

- Freeze changes two weeks before go-live except for break-fixes.

- Document runbooks for integrations and data recovery.

Integration blueprint: CRM x ERP/Inventory/Accounting

Follow a disciplined pattern to avoid costly rework:

- Map entities and ownership

- Accounts/Customers, Contacts, Products/Items/BOM, Opportunities/Quotes, Orders/Invoices, Tickets/RMAs

- Define system-of-record and allowed edits per field; keep ERP the master for items/pricing

- Choose integration methods by use case

- Real-time APIs for order creation and inventory checks; batch nightly jobs for financials/history

- Prefer proven connectors for your pairings before custom builds

- Validation and error handling

- Field-level validation at entry; reference tables (UoM, tax codes) synced from ERP

- Reconciliation reports; alerting on failures; retry strategies

- Test like an auditor

- Golden test cases for quotes, discounts, backorders, returns

- Edge-case stress tests (multi-currency, multi-warehouse, partial shipments)

- Monitor and iterate

- Post-go-live, review sync logs daily for two weeks; weekly thereafter

- Track data drift and duplicate rates; schedule dedupe jobs

NetSuite’s ERP Integration Strategy underscores why this sequence—data profiling, mapping, phased methods, and monitoring—reduces breakage and manual work during handoffs (ERP Integration Strategy — NetSuite).

Data governance and cleansing that won’t overwhelm a small team

A lightweight, pragmatic framework beats perfectionism.

- Define roles: Data Owners (Sales: Customers; Product: Items/BOM; Service: Warranty), Stewards (Ops/IT to enforce rules), and an oversight huddle twice monthly.

- Validation rules: required fields, formats, and referential checks to ERP codes; enforce serial/lot for warranty records.

- Scheduled dedupe: fuzzy match on accounts/contacts quarterly; reconcile product/BOM with ERP monthly.

- KPIs: critical-field accuracy >90%, completeness >95%, duplicate rate <2%, CRM↔ERP mismatch trend downward, user adoption by role.

In 2025, data quality directly impacts AI outcomes and user trust; the State of CRM Data Management report by Validity highlights how poor hygiene undermines AI features and decision-making, especially in SMBs where resources are tight (Validity 2025 CRM data report).

For document and record control aligned to ISO 9001, basic controls—versioning, approvals, retention, and audit trails—can and should live in or near your CRM. DocuWare’s primer provides a concise checklist you can adapt to your workflows (Document control primer — DocuWare).

After-sales service and warranty: build the closed loop

Small manufacturers often differentiate on responsiveness. Treat service data as a sales and engineering feedback loop.

Core practices

- Warranty entitlement checks at ticket creation; auto-attach serials/lot numbers

- RMA workflow with statuses visible to customers and sales

- Parts and labor tracking for true cost-to-serve and margin analytics

- Mobile access for field service; offline capture where bandwidth is limited

- Trend analysis and escalation paths for recurring defects; feed findings to engineering for ECOs

For a practical pattern, O63 shows how to run warranty processes in a mainstream CRM with clear statuses and entitlement logic, providing a useful reference model for small teams (Warranty management leveraging HubSpot — O63).

Safe, useful AI use cases (and their limits) for SMB manufacturers

Start where AI assists humans rather than replaces them:

- Forecast assistance and anomaly alerts at the opportunity and order level

- Lead scoring to prioritize reps’ time, with manual override and transparency

- Automated logging of emails/meetings; AI summaries to cut admin time

- Service triage suggestions and similar-case retrieval for faster resolutions

Constraints to respect

- Garbage-in, garbage-out: bias and errors track your data quality

- Security/privacy: restrict model access to approved fields; log prompts/outputs for audits

- ITAR/export controls: if you serve controlled industries, enforce U.S.-person access, encryption, and containment of sensitive data; confirm vendor data residency and subcontractor controls

Pilot one use case per quarter, measure impact, and expand only after you hit adoption and quality thresholds.

Measuring ROI: define what “good” looks like upfront

Pick a handful of metrics that align to quoting speed, order accuracy, throughput, and retention. Track weekly during pilot, monthly after rollout.

Commercial impact

- Win rate

- Average quote turnaround time

- On-time delivery (indirectly influenced via better coordination)

- Renewal/upsell rate for distributors or service contracts

Efficiency impact

- Hours saved on data entry or reconciliation

- First-contact resolution and warranty cycle time

- Forecast accuracy and schedule adherence

Benchmarks to calibrate expectations

- In a 2024 Total Economic Impact study, Forrester documented significant ROI for manufacturing CRM programs (context: a larger-enterprise deployment), with payback measured in months when adoption and automation are strong. Use as directional only when planning SMB programs (Forrester TEI — Salesforce for Manufacturing, 2024).

Reality check: most small manufacturers see payback in 6–18 months when they nail adoption and the ERP connection, then progressively automate surrounding workflows.

Security and compliance checklist (right-sized for small teams)

- ISO 9001 alignment: version control, approvals, and audit trails for quality records in CRM; link customer-facing records to controlled documents

- CPRA/CCPA: data mapping, consent and DSAR workflows, encryption in transit/at rest, and RBAC; update privacy policies and vendor DPAs

- ITAR (if applicable): U.S.-person access enforcement, data segregation, encryption, audit logging; train staff on handling controlled technical data

For a plain-English privacy refresher, Termly’s 2025 comparison between CCPA and CPRA is a quick starting point for U.S. small businesses to scope privacy workstreams (CCPA vs CPRA — Termly, 2025).

Troubleshooting: common pitfalls and how to avoid them

- Skipping data prep: duplicates and mis-mapped fields will sabotage adoption; do a two-week cleanse before you integrate.

- Over-customizing on day one: configure what you must for quoting and orders; backlog the nice-to-haves.

- Vague system-of-record rules: decide who owns what data, where it lives, and who can change it.

- Neglecting service: warranty data is gold for engineering and sales; build the loop early.

- Training as a one-off: schedule refresher clinics at 30/60/90 days; rotate “power users” as internal coaches.

Download-ready templates you can replicate quickly

- Selection scorecard: criteria above with 1–5 scoring and weightings

- Data mapping sheet: CRM↔ERP entities, field names, transformations, system-of-record

- Pilot plan: users in scope, success metrics, training schedule, exit criteria

- Hypercare checklist: daily error review, adoption dashboard, top-10 fixes, change freeze rules

You can build these in Google Sheets or Notion in under an hour; keep them living documents as you iterate.

Final recommendation

If you need fast time-to-value with clean UX and strong automation, start your demos with HubSpot and Zoho, then pressure-test ERP connectors. If you need deeper field service and warranty with tight ERP coupling, include Microsoft Dynamics 365 and Salesforce, and budget for admin/partner time. Whatever you choose, run a short pilot, integrate only the must-have entities first, and make data hygiene a weekly habit. That’s how small manufacturers actually get CRM to pay off in 2025.