Building a $20,000 Meta Ads PPC Plan for the United States: Benchmarks, Forecasts, and Strategies (2025)

If you manage around $20,000 per month on Meta in the U.S., the difference between “spend” and “scale” usually comes down to disciplined forecasting, ruthless creative iteration, and measurement resilience. Below is the playbook I use to plan, project, and operate a $20k/month program with confidence—grounded in current U.S. benchmarks and hard-won workflows.

1) Start from 2025 U.S. reality, not old rules

- CPMs: In mid-2025, U.S. social CPMs commonly sit in the single digits; Gupta Media reported an average Meta CPM of around $8 in June 2025, with clear seasonal swings noted in their tracker (Gupta Media, 2025). See their methodology and monthly updates in the Gupta Media social ads cost tracker (2025).

- CTR: For traffic-oriented campaigns, late-2024 aggregated telemetry across 150k+ campaigns showed a median CTR near the high 1% range; that directional figure remains a reasonable planning anchor heading into 2025 according to the AgencyAnalytics overview of Facebook ads metrics (2024).

- CPL/CPA: For lead gen, cost pressure rose into 2025. WordStream’s 2025 analysis cites a lead-gen CPL around the high twenties on Facebook, up roughly 20% year over year—useful for directional planning when modeling upper-funnel economics; see the WordStream Facebook Ads Benchmarks 2025.

- Seasonality warning: Expect Q4 to inflate costs, and don’t forget political cycles. Meta inventory tightens during holidays; Strike Social’s holiday guidance highlights how CPMs and CPCs tend to rise in peak periods—plan pacing accordingly, as outlined in Strike Social’s 2024/2025 holiday cost notes.

Bottom line: Use conservative ranges for forecasts and stress test scenarios. Benchmarks are guideposts, not promises.

2) Define business success before you touch Ads Manager

- Be explicit: “We will invest $20,000 this month to acquire 500 new customers at a blended CPA ≤ $40 and a payback period ≤ 60 days.”

- Map the KPI stack: Objective → Primary KPI (CPA/ROAS/CPL) → Guardrails (frequency, CTR, CPM, MER) → Quality signals (LTV cohorts, refund rates, lead-to-opportunity rates).

- Choose attribution windows thoughtfully: Many ecommerce accounts operate on 7-day click/1-day view; lead gen often prefers 7-day click only. Validate against downstream sales data.

Pro tip: Lock your definitions in a shared one-pager so finance, sales, and marketing agree on how “success” will be measured.

3) Build a defensible forecast for $20,000/month

You need a simple model that anyone on the team can audit. These formulas are the backbone:

- Impressions = (Spend / CPM) × 1,000

- Clicks = Impressions × CTR

- Conversions = Clicks × CVR

- CPC = Spend / Clicks = CPM / (CTR × 1000)

- CPA = Spend / Conversions = CPC / CVR

- ROAS = (Conversions × AOV) / Spend

Here’s a working forecast using conservative 2025 U.S. ranges.

Assumptions (prospecting-heavy blend):

- Spend: $20,000

- CPM: $8.00

- CTR: 1.6%

- Site CVR: 2.5% (prospecting blend; validate in GA4)

- AOV: $85 (ecommerce example)

| Scenario | CPM | CTR | CVR | Impressions | Clicks | CPC | Conversions | CPA | Revenue | ROAS |

|---|---|---|---|---|---|---|---|---|---|---|

| Base | $8 | 1.6% | 2.5% | 2,500,000 | 40,000 | $0.50 | 1,000 | $20 | $85,000 | 4.25 |

| Best | $6 | 1.8% | 3.5% | 3,333,333 | 60,000 | $0.33 | 2,100 | $9.52 | $178,500 | 8.93 |

| Worst | $10 | 1.3% | 1.8% | 2,000,000 | 26,000 | $0.77 | 468 | $42.74 | $39,780 | 1.99 |

How to use it:

- Pressure-test your business case across best/worst. If worst-case ROAS breaks your payback math, adjust budget or objective before launch.

- Localize by funnel stage: For retargeting, plug in higher CVR (e.g., 4–6%) and expect higher CTR; for prospecting, be more conservative.

- Reforecast weekly with actuals. Treat this sheet as a living document.

Benchmarks context: The CPM base case aligns with the U.S. 2025 level cited by Gupta Media, while CTR ranges are consistent with late-2024 medians noted by AgencyAnalytics; lead-gen costs trending higher into 2025 are documented by WordStream.

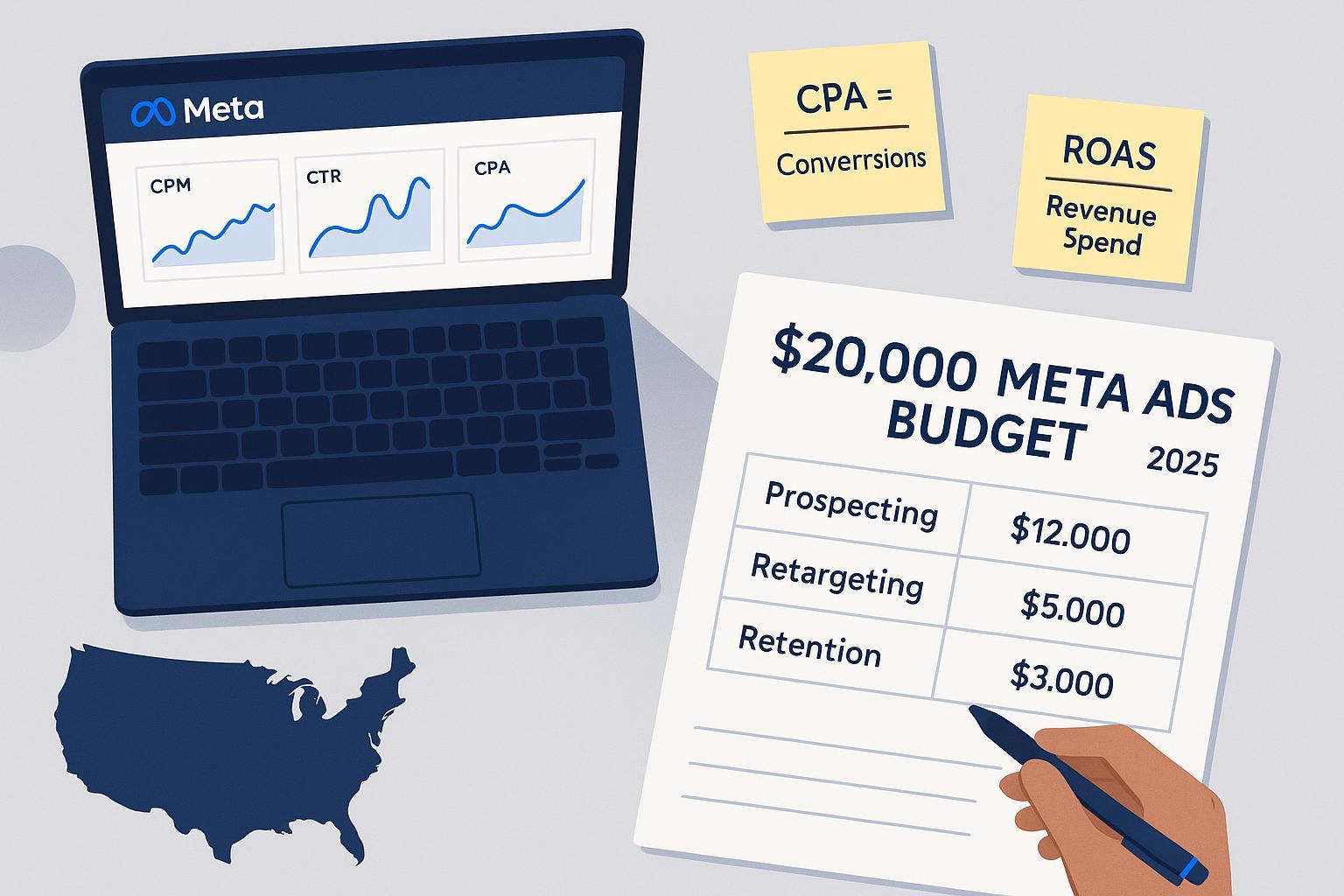

4) Allocate the $20,000 budget with intent

Start with a clear split, then let performance reshape it.

- Prospecting: 55–65% ($11,000–$13,000)

- Retargeting (site engagers, video viewers, IG engagers): 25–35% ($5,000–$7,000)

- Retention/Loyalty (existing customers, LTV expansion): 10–15% ($2,000–$3,000)

Operating notes:

- Keep retargeting pools healthy by feeding them with prospecting volume. If your website traffic is low, over-allocating to retargeting will cap out quickly.

- Use campaign budget automation so Meta can fluidly push dollars to stronger ad sets—then layer human rules for pacing and tests.

Industry nuance:

- High AOV, long consideration (B2B, high-ticket DTC): Shift slightly more into middle-funnel education and longer-running sequences.

- Fast-moving CPG: Heavier prospecting bias; refresh creative faster and lean on short-form video.

5) Use a modern account structure (embrace consolidation)

What works in 2025 is generally fewer, stronger campaigns with automation doing more of the heavy lifting—paired with deliberate testing lanes.

- Advantage+ Sales Campaigns for scale: Meta’s automation consolidates targeting, placements, and budget to accelerate learning and stabilize delivery. Review how these work in the Meta Developers documentation for Advantage Campaigns.

- Broad targeting first, layered creative relevance: Supply clean conversion signals and strong creative variety; avoid over-fragmented interest stacks that starve learning.

- Separate prospecting vs. retargeting campaigns to prevent small pools from being outbid by broad sets; allow budget automation to find pockets of efficiency within each.

- Limit simultaneous ad sets; too many dilute learning. Aim for each ad set to generate ~50 optimization events in a 7-day window to exit learning—guidance reiterated in the Meta Help Center’s learning phase article (2025).

6) Creative strategy: volume, variety, velocity

Creative is the performance engine. My practical rules of thumb for a $20k/month account:

- Inputs per cycle: 6–10 new concepts every 2 weeks; each concept rendered into 3–5 formats (1:1, 4:5, 9:16; static + UGC video variants).

- Hooks and proof: Lead with outcomes, show the product in use in the first 2–3 seconds, and include a concrete proof point (demo, testimonial, social proof).

- Fatigue early-warning: Watch declining CTR and rising CPC at stable spend; refresh when CTR drops ~25% from its 7-day peak.

- Kill/scale rules: Kill if CPA > 1.5× target after 2,000 impressions and 50+ clicks with poor downstream metrics. Scale if CPA ≤ target for 3–4 days and CVR is stable; increase 10–20% every 48–72 hours to preserve learning.

A weekly creative standup to review thumbstop rates, hook efficacy, and first-3-seconds performance will keep your pipeline healthy.

7) Measurement resiliency: Pixel + CAPI + sane attribution

Privacy changes aren’t going away. Build redundancy into your measurement spine.

- Implement both Pixel and Conversions API (CAPI). Server-side events can recover attribution and stabilize optimization. Start with the Meta Conversions API “Get Started” guide (2025).

- Configure Aggregated Event Measurement (AEM) and prioritize the 6–8 most important events for your domain. Mobile-heavy advertisers should follow recent iOS-focused recommendations from partners; Adjust summarized relevant updates in their Adjust explainer on Meta AEM (2024/2025).

- Pick an attribution baseline (e.g., 7D click/1D view for purchases), then triangulate against GA4 and, if available, third-party attribution. Consistency beats perfection.

Practical QA:

- Verify deduplication between pixel and CAPI events.

- Ensure correct currency, time zone, and value parameters at each conversion event.

- Regularly spot-check postbacks against order logs or CRM closes.

8) Optimization and scaling cadence you can trust

Weekly rhythm (30–60 minutes):

- Budget pacing check vs. forecast; update your sheet with actual CPM/CTR/CVR.

- Creative triage: promote two winners, retire two laggards, brief two new concepts.

- Audience health: Inspect frequency and unique reach; throttle retargeting if frequency > 5 with decaying CTR.

Biweekly deep dive (60–90 minutes):

- Funnel-level view: Prospecting vs. retargeting ROAS/CPA, contribution to total conversions, and overlap.

- Placement mix: Unless brand safety demands exclusions, stick with auto placements; selective exclusions only when justified by material outliers.

- Budget increases: If performance is stable or improving, scale 10–20% every 2–3 days to preserve learning. For a nuanced view on budget distribution mechanics, see Jon Loomer’s 2025 write-up on Ad Set Budget Sharing (QVT).

Monthly review (90–120 minutes):

- Creative cohort analysis by theme and hook; identify “evergreen” concepts to recycle quarterly.

- Audience overlap and saturation; test fresh prospecting angles (new creators, demos, use-cases).

- Attribution sanity check: compare Meta-reported vs. GA4 vs. any MMM/attribution tool.

9) Seasonality, election cycles, and risk buffers

- Build a 10–20% contingency: If CPMs surge (Q4, major events), pre-approve a reallocation plan (e.g., shift to higher-intent retargeting or delay top-of-funnel tests).

- Pace ahead of crunch: For Q4, pre-build assets in September, warm audiences in October, and lock promo calendars by early November.

- Inventory volatility: When competition spikes, your best defense is high-CTR creative and clean conversion signals.

For a broader view of platform-level best practices that remain relevant in 2025, Search Engine Land’s overview is a concise reference: Meta advertising best practices (2024).

10) A practical 30/60/90-day plan

Days 1–30 (Foundation and first learnings):

- Tracking & data: Deploy Pixel + CAPI, AEM prioritization, and confirm attribution settings. QA events daily in the first week.

- Forecast & budget: Finalize the $20k forecast (base/best/worst). Approve initial split: 60% prospecting, 30% retargeting, 10% retention.

- Account structure: Launch a consolidated Advantage+ Sales campaign for prospecting (broad); a separate retargeting campaign (stacked warm audiences); a small loyalty campaign.

- Creative: Ship 8–10 concepts across key aspect ratios. Pre-brief the next wave.

- Review cadence: Twice-weekly reviews to stabilize out of learning.

Days 31–60 (Iterate and stabilize):

- Scale winners 10–20% every 2–3 days if KPIs are met; pause chronic underperformers.

- Introduce two new creative concepts weekly; recycle high performers with fresh hooks/CTAs.

- Tighten retargeting by intent (cart/checkout abandoners vs. site engagers) and set frequency caps where needed.

- Start cohort ROAS/LTV analysis on first 30 days of acquired customers.

Days 61–90 (Systemize and expand):

- Test incremental structure changes: a second prospecting lane (new creative theme or creator) and a dedicated catalog/DPAs lane if applicable.

- Explore offer testing: bundles, financing, risk-reversal messaging.

- Build a quarterly creative roadmap; lock a briefing and UGC sourcing cadence.

- Run a measurement audit and reconcile with finance on payback and margin.

11) Common pitfalls I still see (and how to avoid them)

- Fragmented structures that never exit learning: Consolidate. Aim for enough signal density to hit ~50 optimization events per ad set in a week (see Meta’s learning phase guidance linked above).

- Over-targeting by interests/lookalikes: Start broad; let creative do the segmentation lifting.

- Creative starvation: If new concepts aren’t shipping weekly, performance will decay. Protect creative time like you protect budget.

- Scaling too fast: Doubling budgets overnight resets learning and often degrades CPA. Step up 10–20% at a time.

- Thin measurement: Pixel-only setups miss a chunk of conversions. Add CAPI and validate AEM priorities to stabilize optimization.

12) Tooling and templates that actually help

- Forecasting sheet: Keep it simple—plug CPM, CTR, CVR, and AOV into the formulas above. Refresh weekly with actuals and re-forecast the remainder of month.

- Reporting: Build a Looker Studio dashboard for daily pulse (pacing, CPA/ROAS, CTR, CPC, CVR) and a weekly deck for insights.

- Creative tracker: Maintain a grid of every concept, hook, format, creator, launch date, and status (win/lose/iterate). This is your growth engine logbook.

If you’re evolving your learning about Meta’s automation and practical tactics, this compact industry rundown is a useful perspective to cross-check your approach in 2025: Meta advertising best practices (2024) by Search Engine Land.

13) Quick QA checklist before launch

- Tracking

- Pixel firing on key pages and events; CAPI deduping confirmed.

- AEM priorities set; attribution window aligned to business reality.

- Campaigns

- Prospecting: Advantage+ Sales with broad targeting and creative variety.

- Retargeting: Stacked warm audiences, right exclusions, sensible frequency.

- Budget automation enabled; spend split aligned to forecast.

- Creative

- 6–10 concepts ready; multiple aspect ratios; first 3 seconds tested.

- UGC + product demo mix; clear offers and proof points.

- Governance

- Forecast base/best/worst saved; weekly review cadence booked.

- Kill/scale rules documented and shared with the team.

14) Why this playbook works

- It grounds strategy in current U.S. cost realities (CPM, CTR, CPL/CPA) with defensible ranges.

- It operationalizes learning-phase needs—signal density, consolidation, and creative cadence.

- It treats forecasting as an ongoing control system, not a one-time spreadsheet.

- It acknowledges seasonality and platform volatility—and gives you buffers and rules to navigate both.

For deeper reference on any of the keystones mentioned above, consult: the Gupta Media social ads cost tracker (2025) for CPM context; the AgencyAnalytics overview of Facebook CTRs (2024); WordStream’s Facebook Ads Benchmarks 2025 for CPL trends; Meta’s docs on the learning phase and Conversions API setup; the Advantage Campaigns developer documentation; holiday cost context from Strike Social; and budget mechanics insights from Jon Loomer (2025).

If you implement this plan as written—and keep iterating weekly—you’ll have a $20k Meta program that’s predictable, scalable, and resilient in 2025.