Google removes the “&num=100” parameter (2025): what broke, what’s noise, and how marketers should respond now

Updated on: September 30, 2025

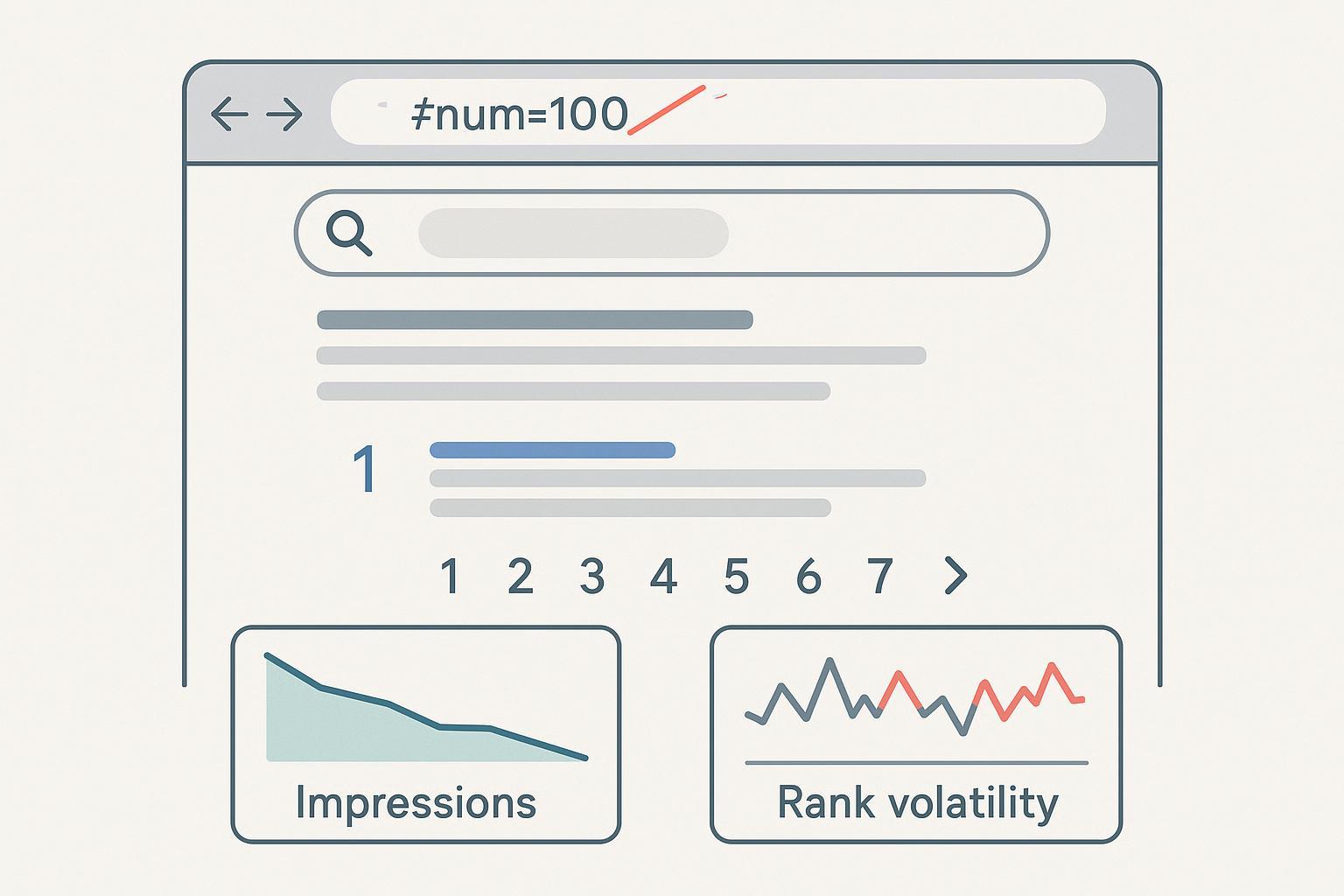

If your rank trackers glitched and your Google Search Console (GSC) impressions fell off a cliff this month, you’re not alone. In mid-September 2025, Google disabled the “&num=100” URL parameter that used to force 100 results per SERP page, effectively limiting visible results to 10 per page and pushing tools to paginate. Multiple industry outlets confirmed the change — see the 2025 coverage by Search Engine Journal and Search Engine Land’s disruption overview.

What changed technically — and why that matters

The “&num=100” parameter no longer returns 100 results. Post-change, tools and practitioners must request pages in 10-result increments (start=0,10,20,…,90) to collect a top 100 snapshot. That implies roughly a 10x request increase for the same coverage, which explains why some dashboards slowed or briefly showed gaps while vendors retooled. Google has since clarified that it does not support a results-per-page parameter, as reported in Search Engine Land’s 2025 confirmation note.

Operationally, this means:

- Rank trackers incur higher crawl costs and face tighter rate limits.

- Some providers will reduce frequency or depth to maintain stability.

- Manual checks now require paginated requests instead of a single 100-result view.

The KPI distortion you’re seeing (and why it’s not necessarily performance)

Two things likely appeared in GSC for mid-September onward: impression declines and “better” average positions. That doesn’t mean your SEO suddenly surged while visibility collapsed. In a 2025 dataset of 319 properties, Search Engine Land’s impact analysis reported that 87.7% of sites saw impression drops and 77.6% lost unique ranking terms — while average positions often improved. The artifact: fewer lower-SERP impressions are being counted, so the distribution skews toward higher positions.

Brodie Clark’s 2025 commentary frames this as part of a broader “decoupling” from non-user influences that historically inflated certain metrics; it’s a helpful lens for explaining why averages improved while impressions fell. See Brodie Clark’s “Great Decoupling” analysis (2025).

Immediate actions to stabilize your reporting

- Add annotations across GA4, Looker Studio, and internal dashboards for Sept 12–15, 2025.

- Split trendlines: treat data through Sept 10 as “pre-change” and from Sept 15 onward as “post-change.” Avoid averaging metrics across the boundary.

- Footnote your Q3/Q4 reports to clarify that impression declines and average position shifts reflect methodology, not sudden demand changes.

- Re-scope rank tracking so you control cost and still get signal

- Prioritize revenue-driving and strategic keywords. If vendors pass through higher crawl costs, your budget will go further by focusing on terms that matter.

- Stagger daily crawls into alternating cohorts to maintain breadth without a cost spike.

- QA a critical subset manually using paginated checks (start=0,10,…,90) and compare with tool outputs.

- Reframe KPIs toward outcomes

- Shift emphasis from raw impressions to clicks, conversions, assisted revenue, and share of non-brand clicks.

- When you discuss “search visibility,” define the metric explicitly for stakeholders and be consistent in how you calculate it; if you need a refresher, this primer on search visibility score can help you document a post-change methodology that’s durable.

- Reset targets and communicate the change

- Freeze old impression/visibility targets and create new baselines starting mid-September.

- In Q4 reviews, compare against the new baseline and keep pre/post views separate.

Budget and workflow mitigation (SMBs vs. agencies)

- Trim the keyword universe to the terms that drive pipeline (brand protection, top products, top categories) and a rotating sample of discovery queries.

- Monitor SERP features (People Also Ask, Top Stories, local packs) for priority queries — those influence clicks more than positions 20–100.

For agencies and multi-account teams

- Build tiered cohorts: Tier 1 (daily), Tier 2 (2–3x weekly), Tier 3 (weekly) based on client objectives and budgets.

- Standardize a one-page explainer so account leads can quickly brief clients when dashboards move.

- Expect cross-tool variance to be higher than usual for a few weeks as vendors tune pagination and rate limits.

Optional tool diversification

- If you’re reassessing stack coverage, curated lists of accessible tools (e.g., this roundup of Fiverr SEO tools) can help you pilot low-risk add-ons while primary vendors stabilize.

Tooling notes and a neutral workflow helper

Platforms that centralize topic research, content planning, and lightweight analytics can streamline the extra checks you’ll run over the next month. For example, QuickCreator supports SERP/topic guidance and SEO-friendly publishing workflows, which can be useful when you’re recalibrating content plans and reporting.

Disclosure: QuickCreator is our product.

No tool removes the need for careful KPI resets or ethical data practices here — but consolidating steps (briefing, drafting, annotating, and reviewing) can save cycles while rank trackers and GSC trends normalize.

A concise communication kit for stakeholders

Use this structure when leadership or clients ask, “Why did impressions drop?”

- What changed: “In mid-September 2025, Google stopped supporting a parameter that showed 100 results per page. Tools now fetch data via pagination, which changed how lower-position impressions are recorded.”

- What we’re seeing: “Impressions are down and average positions look better. This is a measurement shift, not an immediate drop in demand or a sudden SEO jump.”

- What we’re doing: “We annotated reports, split pre/post baselines, prioritized critical keywords, and shifted focus to clicks and conversions. We’re monitoring weekly and will update targets accordingly.”

- What to expect: “Short-term volatility across tools; clearer, more decision-grade metrics by October once baselines are reset and vendors complete adjustments.”

Monitoring, compliance, and what to watch next

- Respect rate limits and robots.txt; avoid aggressive scraping.

- Expect vendors to publish pagination and refresh rate updates through early October.

- Keep an eye on GSC averages: if “average position” looks better, confirm whether clicks also improved before celebrating.

- For context on the initial industry confirmation and timeline, see the 2025 reports from Search Engine Journal and Search Engine Land’s disruption overview. If you need additional perspective on why metrics may “decouple,” revisit Brodie Clark’s 2025 analysis.

If your organization is expanding research beyond Google while the dust settles, consider a temporary emphasis on alternative search engines for competitive scanning and content discovery. Don’t mix those results into Google KPIs, but they can inform ideas and cross-channel bets.

Change-log and update cadence

- September 30, 2025: Initial publication with technical summary, KPI normalization playbook, and communication kit.

- October 10, 2025: Planned update with early October GSC trends and vendor pagination stability notes.

- October 31, 2025: Month-end review with example KPI normalization and baseline snapshots.

Why this matters for timing: The next two to three weeks are the “golden window” to reset expectations before October reporting cycles. We’ll refresh this post on the dates above or sooner if Google publishes formal guidance.

Sources cited (in context above)

- 2025 confirmations and disruption coverage by Search Engine Journal and Search Engine Land; Google’s “not supported” clarification reported by Search Engine Land; and Brodie Clark’s 2025 analysis of decoupling dynamics.