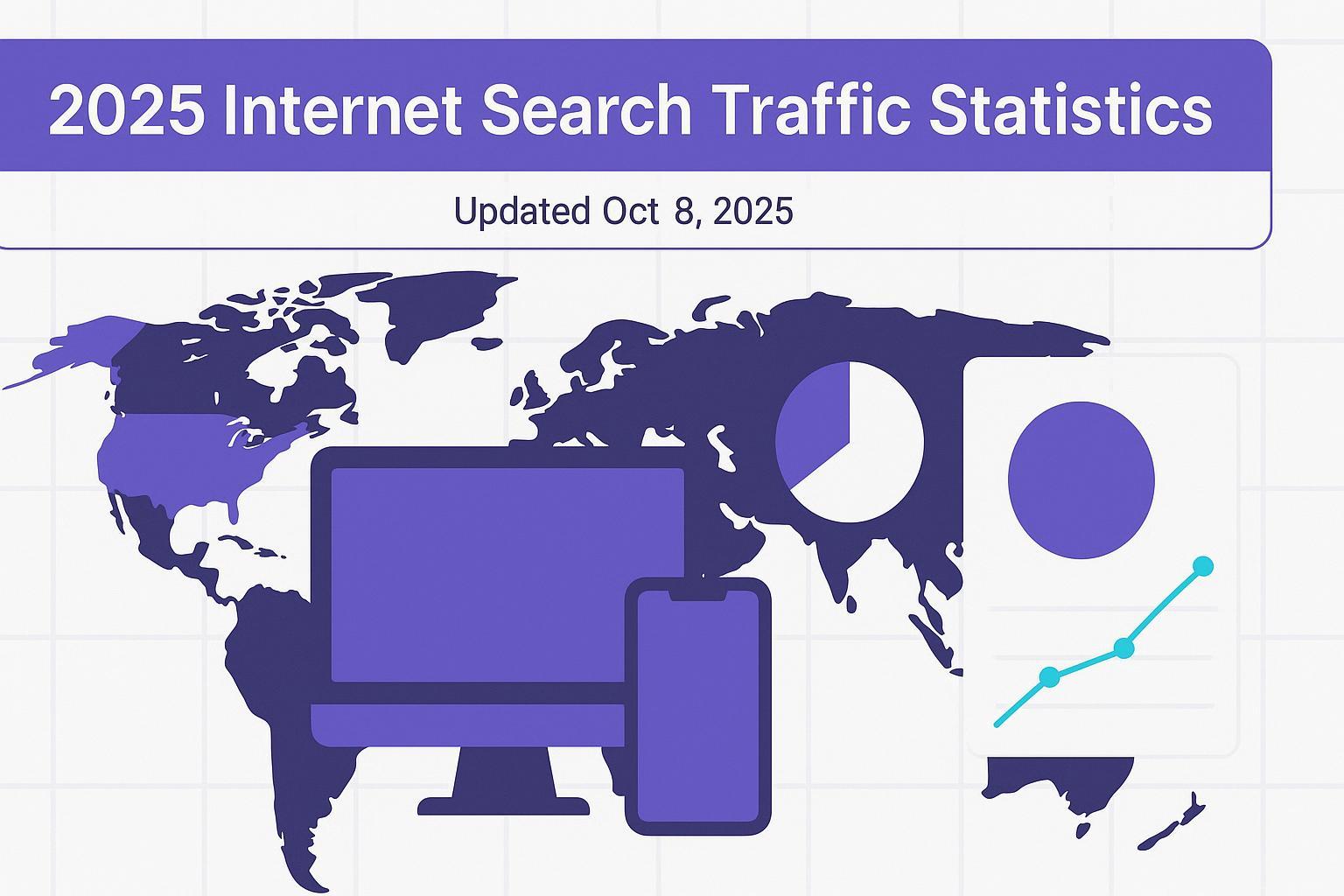

2025 Internet Search Traffic Statistics (Worldwide + US/UK/CA/AU; Desktop vs Mobile)

Updated Oct 8, 2025 — This is a comprehensive, citable roundup of 2025 internet search statistics for marketers and SMB leaders. It consolidates the latest open data across market share, zero‑click behavior, AI Overviews coverage, CTR benchmarks, local search habits, branded vs non‑branded mix, and more. We include Worldwide and country snapshots (United States, United Kingdom, Canada, Australia) and call out Desktop vs Mobile where credible sources support it.

If you build strategy decks, budget plans, or blog content, you can reference the figures here with confidence and copy the CSV export near the end.

1) Search Engine Market Share — 2025 Overview

StatCounter remains the most widely cited, open‑access tracker of search engine market share. As of September 2025, Google holds ≈90.4% worldwide; Bing ≈4.08%; the remainder split among Yahoo!, Yandex, DuckDuckGo, Baidu, and others. These figures reflect referral share across StatCounter’s pageview instrumentation network and update monthly. See the current dashboard at StatCounter’s Worldwide 2025 market share.

Notes on devices:

Desktop worldwide tends to show a relatively higher Bing share (≈10–11%) and lower Google share (≈80–83%) versus mobile, which is more Google‑heavy (>90%). Device‑split precision varies by month and geography; consult dashboard toggles and timestamp your pulls.

Worldwide — Overall (Sep 2025)

Engine | Share (%) |

|---|---|

≈90.4 | |

Bing | ≈4.08 |

Yahoo! | ≈1.46 |

Yandex | ≈1.65 |

DuckDuckGo | ≈0.87 |

Baidu | ≈0.75 |

How to cite: “StatCounter Global Stats. ‘Search Engine Market Share Worldwide — 2025.’ Accessed Oct 8, 2025.”

Country snapshots — Overall (Sep 2025)

These are indicative 2025 shares drawn from StatCounter country dashboards. For device splits (desktop/mobile) by country, use dashboard toggles and note the capture date.

Country | Google (%) | Bing (%) | Yahoo! (%) | Notes |

|---|---|---|---|---|

United States | ≈85–86 | ≈7–8 | ≈2–3 | Desktop Bing share notably higher than mobile; Google dominance strongest on mobile |

United Kingdom | ≈90± | ≈4–6 | ≈1–2 | Mobile skews more Google‑heavy |

Canada | ≈90± | ≈4–6 | ≈1–2 | Similar to UK; desktop slightly boosts Bing |

Australia | ≈90± | ≈4–6 | ≈1–2 | Pattern mirrors UK/Canada |

Methodology caveat: StatCounter measures referral share (not raw query counts). Country splits vary with local device mix and site composition. Always record your capture month.

2) Daily/Monthly Search Volumes (Google/Bing)

Open sources rarely publish globally consistent daily search volumes by engine. Many quoted numbers (e.g., “Google processes X billion searches per day”) trace back to older, unattributed estimates. For 2025 planning, rely on market share and CTR/zero‑click behavior rather than speculative daily counts. If you must reference volumes, qualify them as estimates and prefer official documentation when available.

3) Organic vs Paid & CTR by Position (2025)

Click‑through rates vary by device, industry, and SERP features. For 2025, use live trackers and recent summaries to understand typical performance.

Advanced Web Ranking’s monthly tool reports device and industry variability; use the live dataset at AWR’s Google Organic CTR tool and timestamp your pull.

A typical organic CTR curve for “clean” SERPs (i.e., fewer heavy features) places Position #1 around the mid‑30s to 40% range on desktop, with mobile somewhat lower. In Q2 2025, AWR reported a modest drop in desktop Position #1 CTR versus Q1, while mobile stayed relatively stable (industry‑dependent).

Action notes:

Expect lower CTRs when AI Overviews, Local Pack, or multiple ads appear. Plan content to earn visibility in features (FAQ/HowTo schema) and maintain a compelling title/meta to protect clicks.

4) Zero‑Click Search Rates & AI Overviews Coverage

The overall zero‑click rate across Google searches rose from 56% (May 2024) to 69% (May 2025), based on session‑level analysis. See the methodology and trend in Similarweb’s zero‑click analysis (May 22, 2025).

When AI Overviews are present, Similarweb observed median zero‑click ≈80% and average ≈83% in 2025, reflecting how on‑SERP answers suppress clicks.

Coverage: On US desktop, AI Overviews appeared in ≈13.14% of searches in March 2025 (sample: 10M+ keywords with Datos clickstream), according to Semrush’s 2025 AI Overviews study. Coverage fluctuates by query type and week.

Implications for marketers:

Design content that’s both “answer‑ready” for on‑SERP visibility and robust enough to win the click. Use structured summaries, citations, and schema (FAQ, HowTo) to compete in high zero‑click contexts.

Further reading: Our guide on zero‑click strategies and tactical responses explains how to adapt formats and measurement.

5) AI Search Referrals vs Google (External Traffic Share)

Despite growing usage of AI assistants, Google remains the dominant external traffic driver in 2025.

In June 2025, the top 1,000 global domains received 191 billion visits from Google versus 1.13 billion from AI platforms (ChatGPT, Gemini, DeepSeek, Grok, Perplexity, Claude, Liner), per Similarweb’s analysis. That places AI at ≈0.59% of these referrals, with Google sending roughly 169× more visits. See Similarweb’s AI referral traffic winners.

“So what”:

Keep organic search as a primary acquisition channel in 2025. Test AI referral capture strategies (consensus‑friendly answers, citation‑ready pages), but expect small volumes relative to Google.

6) SERP Feature Prevalence (Snippets, PAA, Local, Media)

Feature prevalence is highly dependent on query intent and device. Robust, open 2025 percentages for features like People Also Ask (PAA), Local Pack, and Top Stories are limited. What’s consistent:

AI Overviews have measurable coverage (~13% on US desktop in March 2025).

Local intent queries frequently surface Map/Local Pack modules.

Product queries often show images; informational queries may trigger snippets or PAA.

Practical approach:

Tag pages by intent (local, transactional, informational) and implement relevant schema. Monitor feature presence in your keywords monthly.

7) Local Search Behavior & “Near Me” Trends (US; 2025)

US consumers continue to rely on Google for local discovery and reviews.

In 2025 BrightLocal findings, 83% of consumers use Google to find local business reviews, and the majority search for local businesses at least weekly. See the latest survey pages in BrightLocal’s Local Consumer Review Survey 2025.

Prioritize LocalBusiness, Organization, and Review schema.

Maintain accurate NAP, hours, and services. Optimize for Map Pack survival with category alignment and review velocity.

8) Vertical/Alternative Search Usage (Discovery beyond Google)

Discovery increasingly happens on platforms like YouTube and TikTok, especially among younger cohorts. While these aren’t “search engines” in the strict sense, they function as discovery tools for products and information. For budget planning, consider a small allocation to platform‑native content and optimize for platform search (titles, descriptions, tagging). Device behavior (mobile‑first) amplifies this effect.

9) Branded vs Non‑Branded Query Mix (U.S., 2025)

Large‑scale U.S. keyword analysis suggests branded queries are a bigger slice of total volume than many assume.

Ahrefs found ≈36.9% of unique keywords are branded, but by total search volume, ≈45.7% is branded (non‑branded ≈54.3%). Sample: ≈150M U.S. keywords; branded definition excludes celebrity names. See details in Ahrefs’ 2025 branded vs non‑branded study.

Implications:

Invest in brand demand creation (content, PR, social, partnerships). Branded share strengthens resilience against zero‑click and feature‑heavy SERPs.

10) Impact of Major 2025 Google Updates (Core/Spam)

2025 saw notable volatility (e.g., June core, August spam). Smaller publishers sometimes reported gains after the June core update, while some sectors faced sharper fluctuations. Practical takeaway: maintain content quality, helpfulness, and technical hygiene. Track changes alongside update timelines to understand causality.

11) Practical Workflow: Designing Content for High Zero‑Click SERPs

When zero‑click rates are elevated and AI Overviews may appear, use a “visible‑without‑click” approach while preserving depth:

Start with a consensus‑friendly summary (2–3 sentences) that directly answers the query.

Add a structured FAQ block targeting follow‑up questions; apply FAQ/HowTo schema.

Cite authoritative sources inline to increase credibility.

Include scannable tables or bullet lists for stats/data.

Offer a deeper section that expands the topic (case examples, methods) to win clicks.

You can implement this at scale with QuickCreator. Disclosure: QuickCreator is our product. It supports schema, SEO‑ready formatting, managed hosting, and fast publication so your content is eligible for citations and features while remaining conversion‑friendly.

Further reading (internal):

AI Overviews impact guide: Google AI Overviews and SEO implications

SEO fundamentals primer: What is SEO and how it works

12) Quick‑reference tables (geo/device)

Where exact device splits are not publicly permalinked, use StatCounter’s toggles and timestamp your extraction.

Market share — Worldwide & key countries (Sep 2025)

Geography | Device | Bing | Yahoo! | DuckDuckGo | Notes | |

|---|---|---|---|---|---|---|

Worldwide | Overall | ≈90.4% | ≈4.08% | ≈1.46% | ≈0.87% | Desktop Bing higher; mobile more Google‑heavy |

Worldwide | Desktop | ≈80–83% | ≈10–11% | ≈2–3% | ≈1% | Ranges across 2025 months |

Worldwide | Mobile | >90% | ≈3–5% | ≈1% | <1% | Google strongest on mobile |

United States | Overall | ≈85–86% | ≈7–8% | ≈2–3% | <1% | Desktop raises Bing share |

United Kingdom | Overall | ≈90±% | ≈4–6% | ≈1–2% | <1% | Mobile skews Google |

Canada | Overall | ≈90±% | ≈4–6% | ≈1–2% | <1% | Similar to UK |

Australia | Overall | ≈90±% | ≈4–6% | ≈1–2% | <1% | Similar to UK/CA |

Zero‑click & AI Overviews — 2025

Metric | Period & Geo | Value | Source |

|---|---|---|---|

Zero‑click overall | May 2025 (Google, global sessions) | 69% | Similarweb (session analysis) |

Zero‑click w/ AI Overviews | 2025 (global sessions) | Median ≈80%; Avg ≈83% | Similarweb |

Mar 2025 (US desktop) | ≈13.14% of searches | Semrush (10M+ keywords) |

Branded vs non‑branded (U.S.)

Metric | Scope | Value | Source |

|---|---|---|---|

Share by unique keywords | ≈150M U.S. keywords | Branded ≈36.9% | Ahrefs |

Share by total search volume | ≈150M U.S. keywords | Branded ≈45.7%; Non‑branded ≈54.3% | Ahrefs |

13) CSV/Google Sheet‑ready export (copy/paste)

Dataset,Geography,Device/Scope,Period,Metric,Value,Source URL,Capture Date

Market Share,Worldwide,Overall,Sep 2025,Google,90.4%,https://gs.statcounter.com/search-engine-market-share/all/worldwide/2025,2025-10-08

Market Share,Worldwide,Overall,Sep 2025,Bing,4.08%,https://gs.statcounter.com/search-engine-market-share/all/worldwide/2025,2025-10-08

Market Share,United States,Overall,Sep 2025,Google,85-86%,https://gs.statcounter.com/search-engine-market-share/all/united-states-of-america/2025,2025-10-08

Market Share,United Kingdom,Overall,Sep 2025,Google,~90%,https://gs.statcounter.com/search-engine-market-share/all/united-kingdom/2025,2025-10-08

Market Share,Canada,Overall,Sep 2025,Google,~90%,https://gs.statcounter.com/search-engine-market-share/all/canada/2025,2025-10-08

Market Share,Australia,Overall,Sep 2025,Google,~90%,https://gs.statcounter.com/search-engine-market-share/all/australia/2025,2025-10-08

Zero-Click,Global Sessions,Overall,May 2025,Zero-Click Rate,69%,https://www.similarweb.com/blog/marketing/seo/zero-click-searches/,2025-10-08

Zero-Click,Global Sessions,With AI Overviews,2025,Median Zero-Click,80%,https://www.similarweb.com/blog/marketing/seo/zero-click-searches/,2025-10-08

AI Overviews,United States,Desktop,Mar 2025,Coverage,13.14%,https://www.semrush.com/blog/semrush-ai-overviews-study/,2025-10-08

AI Referrals vs Google,Top 1000 Sites,Overall,Jun 2025,AI Referral Visits,1.13B,https://www.similarweb.com/blog/insights/ai-news/ai-referral-traffic-winners/,2025-10-08

AI Referrals vs Google,Top 1000 Sites,Overall,Jun 2025,Google Referral Visits,191B,https://www.similarweb.com/blog/insights/ai-news/ai-referral-traffic-winners/,2025-10-08

CTR,Global,Device/Industry varies,2025,Use live tool,N/A,https://www.advancedwebranking.com/free-seo-tools/google-organic-ctr,2025-10-08

Branded vs Non-Branded,United States,~150M keywords,2025,Branded Share (volume),45.7%,https://ahrefs.com/blog/almost-half-of-google-searches-are-branded-study/,2025-10-08

Branded vs Non-Branded,United States,~150M keywords,2025,Non-Branded Share (volume),54.3%,https://ahrefs.com/blog/almost-half-of-google-searches-are-branded-study/,2025-10-08

Local Behavior,United States,Consumers,2025,Use Google for reviews,83%,https://www.brightlocal.com/research/local-consumer-review-survey/,2025-10-08

14) Appendix: Source list and methodology notes

StatCounter Global Stats — market share (worldwide & countries). Measures share of search engine referrals via pageview instrumentation; monthly updates. Accessed Oct 8, 2025.

Similarweb — zero‑click analysis (May 22, 2025) and AI vs Google referral traffic (June 2025). Clickstream/session‑level measurement; scope notes (e.g., top 1,000 domains for referral comparison).

Semrush — AI Overviews prevalence study (US desktop, March 2025; 10M+ keywords with Datos clickstream). SERP feature tracking across large keyword sets.

Advanced Web Ranking — monthly Google Organic CTR tool with device/industry filters; use live pulls and annotate dates.

Ahrefs — branded vs non‑branded mix study (≈150M U.S. keywords; volume vs unique keyword shares).

BrightLocal — Local Consumer Review Survey 2025 (US panel ≈1,000+ adults; methodology on their research pages).

How to cite (recommended):

“StatCounter Global Stats. ‘Search Engine Market Share Worldwide — 2025.’ Accessed Oct 8, 2025.”

“Similarweb. ‘Zero‑Click Searches and How They Impact Traffic.’ Published May 22, 2025; accessed Oct 8, 2025.”

“Semrush. ‘We Studied 200,000 AI Overviews: Here’s What We Learned.’ Data from March 2025; accessed Oct 8, 2025.”

“Advanced Web Ranking. ‘Google Organic CTR Tool.’ Accessed Oct 8, 2025.”

“Ahrefs. ‘Almost Half of Google Searches Are Branded.’ Published May 30, 2025; accessed Oct 8, 2025.”

“BrightLocal. ‘Local Consumer Review Survey 2025.’ Accessed Oct 8, 2025.”

Update policy: We refresh market share monthly and revisit zero‑click/AIO coverage as tools publish new datasets. CTR pulls should be timestamped quarterly.

15) What to do next (soft CTA)

Turn the stats above into SEO‑ready, structured articles and landing pages your audience and search engines will love. If you want a faster way to produce and publish this content at scale, consider using QuickCreator to streamline writing, schema, and hosting.

Change‑log: Initial publication with 2025‑10‑08 update; tables and CSV aligned to latest open sources. We’ll append monthly StatCounter refreshes and note notable movements in AI Overviews coverage or zero‑click rates.